401k to roth ira tax calculator

Keep in mind that while there are no income limitations to contribute to a Traditional IRA you are not eligible for a Roth IRA if your income level is too high. You can also use the Roth Conversion Calculator to get ideas for how much to convert this year.

Roth Ira Calculator Excel Template For Free

Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

. It is named after subsection 401k in the Internal Revenue Code which was made possible by the Revenue Act of 1978. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. Additionally you dont have to pay taxes when you make qualified withdrawals.

Simple 401k Calculator Terms Definitions. A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement.

Owner partners and spouses have several options for tax-advantaged savings. Traditional IRA or call us at 866-855-5635 for help. 1 With Fidelity you have a broad range of investment options including.

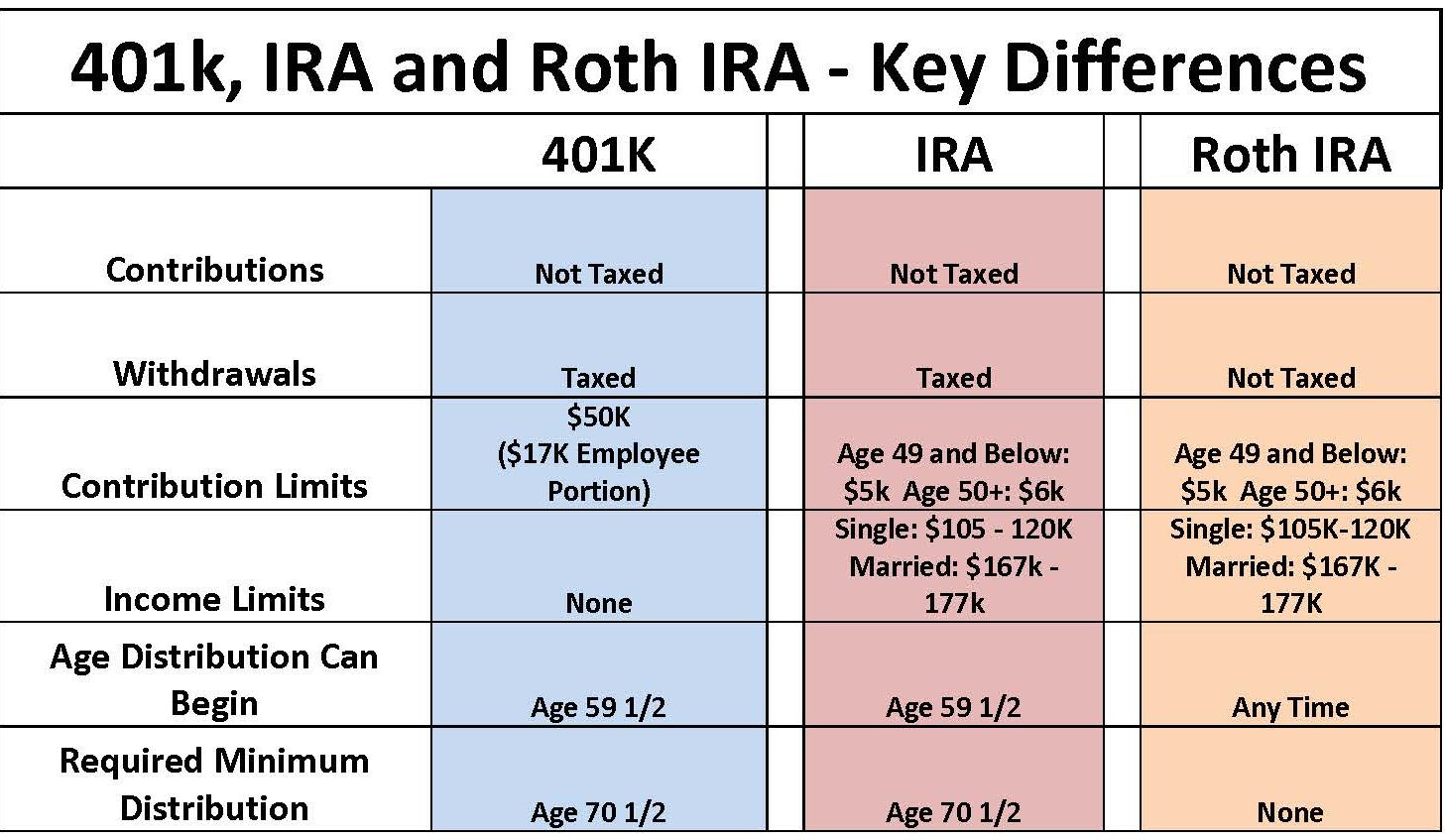

Money in a traditional 401k or IRA grows tax deferred meaning that you pay taxes on the money when you withdraw the funds and no taxes at all when you invest the money. Since you invest in your Roth IRA with money thats already been taxed the money inside the account grows tax-free and you wont pay a dime in taxes when you withdraw your money at retirement. Required minimum distributions RMDs Most owners of traditional IRAs and employer-sponsored retirement plan accounts like 401ks and 403bs must withdraw part of their tax-deferred savings each year starting at age 72 age 70½ if you attained age 70½ before 2020.

A Roth 401k is an account funded with after-tax contributions. This IRS 401k document gives a brief overview with links to. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears.

What is the after tax impact of switching from a traditional IRA to a Roth IRA. Find out how much you can contribute to your Solo 401k with our free contribution calculator. Traditional 401ks allow pre-tax contributions taxable withdrawals.

The funds converted to your Roth IRA whether they come from the 401k or your IRA will generally be taxable. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. With tax benefits that are mainly available through an employer.

Grow Crypto Gains Tax Free with Roth 401k. Converting to a Roth IRA may ultimately help you save money on income taxes. Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation Salary Deferral Contribution In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can be contributed to a Solo 401k 2021 limits are 19500 and 26000 if age 50 or older. Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rulesThis is much different than a Traditional IRA which taxes withdrawalsContributions can be withdrawn any time you wish and there are no required. Its side-by-side comparison of data gives you the information you need to make a decision that is right for you.

Here are some advantages a Roth IRA has over a 401k. Save on taxes and build for a bigger retirment. Unlike a 401k you contribute to a Roth IRA with after-tax money.

Heres how to choose between a Roth IRA and a Traditional IRA Jump ahead for more tips on choosing between an IRA and a 401k. A 401k is a form of retirement savings plan in the US. A Solo 401k plan a SEP IRA a SIMPLE.

401K and other retirement plans. If you return the cash to your IRA within 3 years you will not owe the tax payment. It shares certain similarities with a traditional 401k and a Roth IRA although there are important.

The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free. A Roth 401k gives you a similar tax me once advantage except that you get taxed at the beginning rather than the end. Learn more about the differences between a Roth vs.

With a Roth 401k you can take advantage of the company match on your contributions if your employer offers onejust like a traditional 401k. If you are asking if you can take a distribution non-conversion from the Roth solo 401k that was funded through the conversion of solo 401k voluntary after-tax contributions instead of transferring the funds to a Roth IRA yes you can provided you have both had the Roth solo 401k for 5 years and have reached age 59 12. Related Retirement Calculator Roth IRA Calculator Annuity Payout Calculator.

And the Roth component of a Roth 401k gives you the benefit of tax-free. 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code. This 401k withdrawal calculator will help you decide whether to take a lump-sum distribution or to rollover to a tax-deferred account.

Heres more on the pros and cons of the IRA vs. FAQ Bitcoin In the Solo 401k. The Roth 401k was introduced in 2006 and combines the best features from the traditional 401k and the Roth IRA.

What is the after tax impact of switching from a traditional IRA to a. A Roth IRA can be a powerful way to save for retirement since potential earnings grow tax-free. See the Roth IRA article for more.

Then from there you can convert any amount you wish to your Roth IRA. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. Do it yourself retirement planning.

This is an easy way to accomplish both a tax-free rollover of some funds and a Roth conversion for the rest.

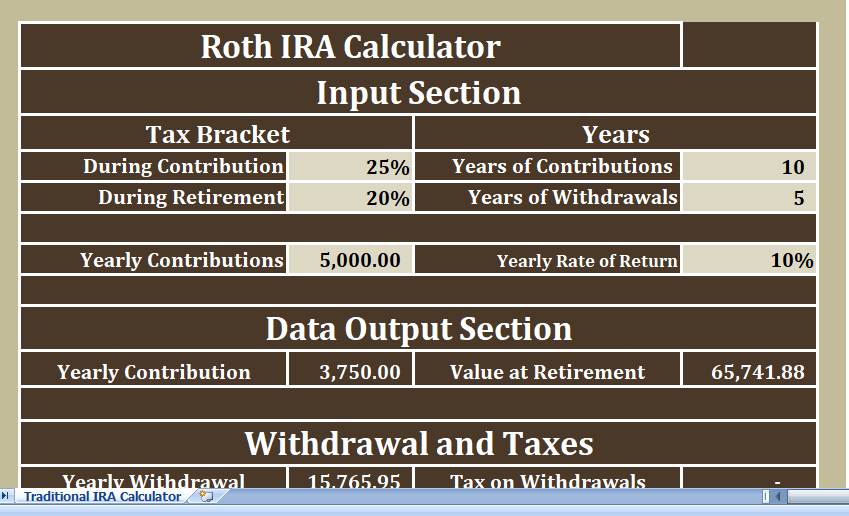

Traditional Vs Roth Ira Calculator

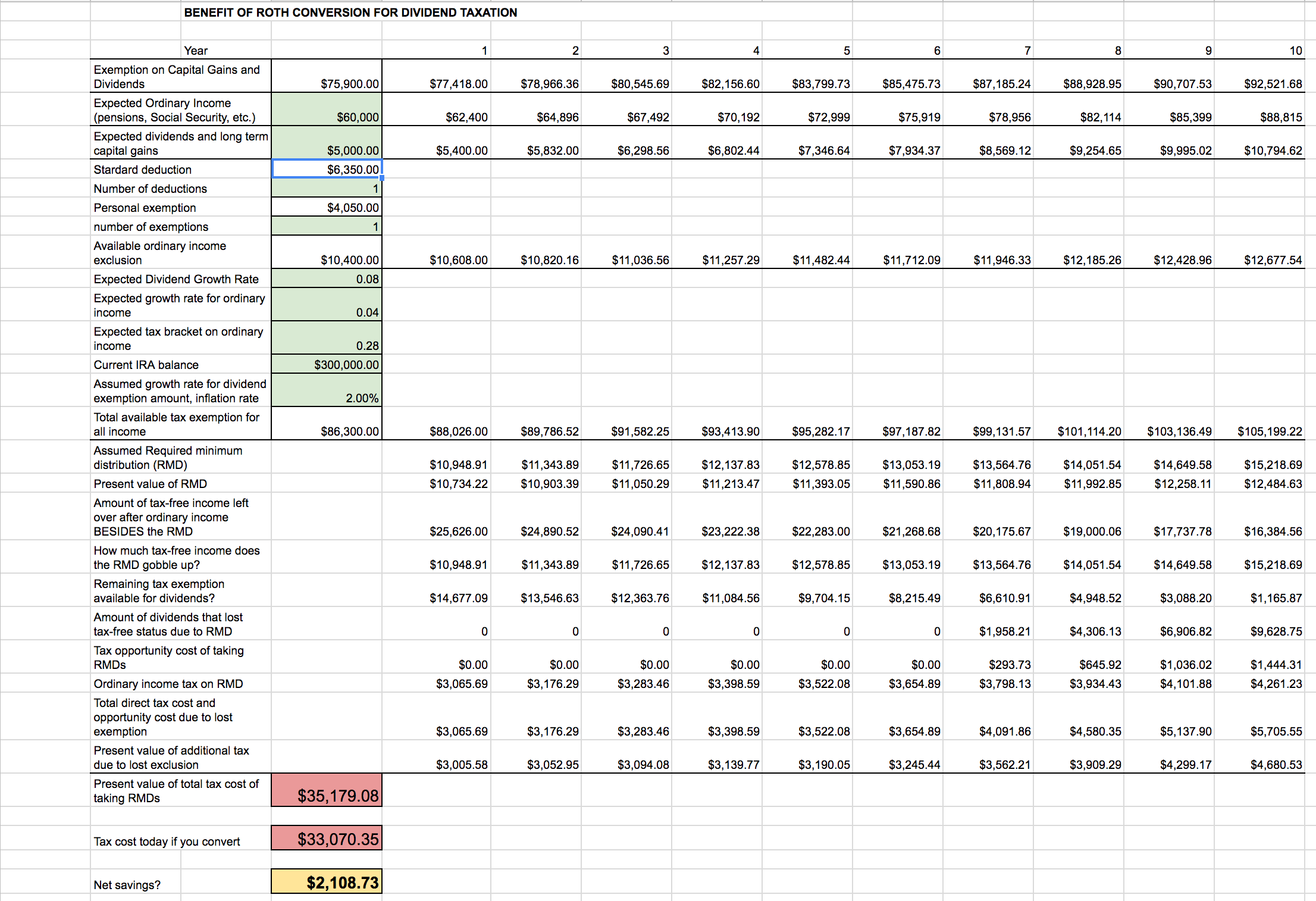

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

The Ultimate Roth 401 K Guide District Capital Management

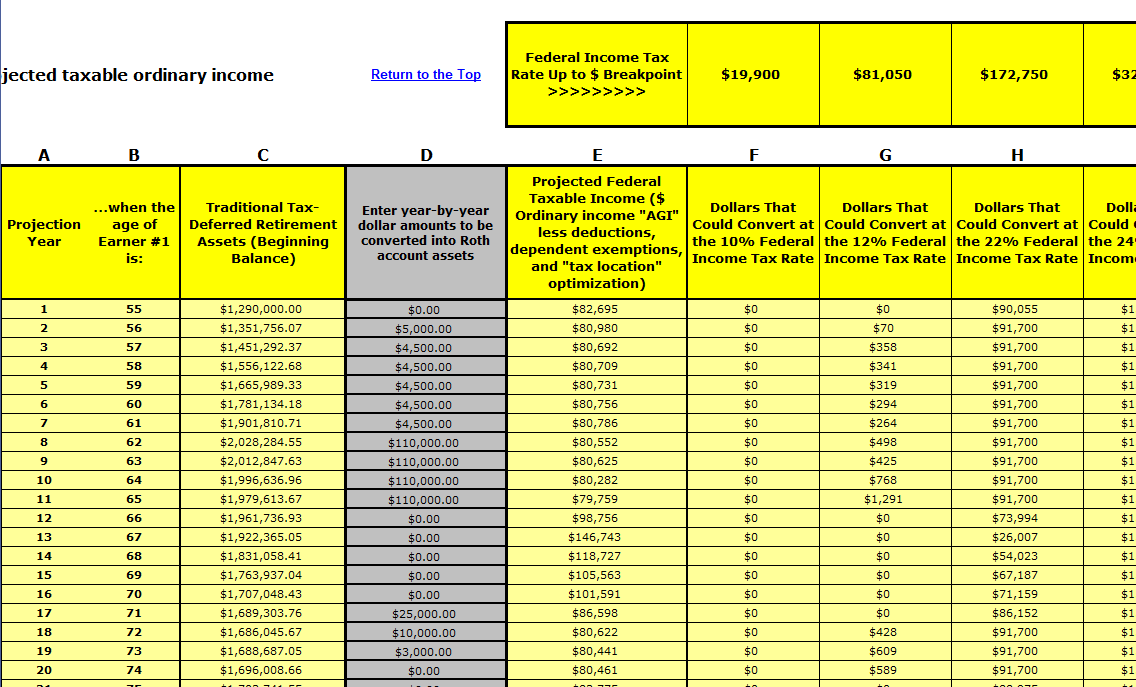

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

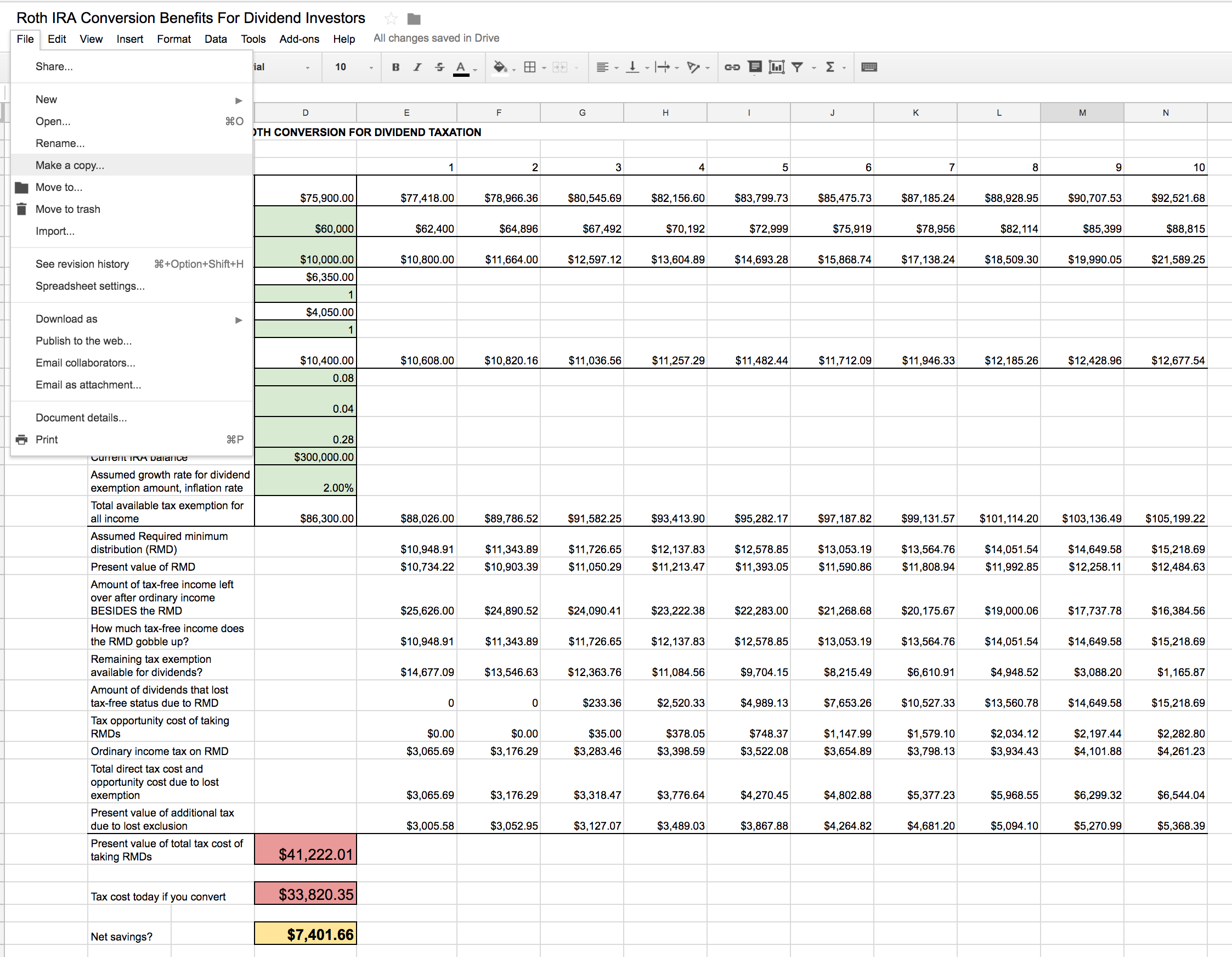

Roth Ira Conversion Spreadsheet Seeking Alpha

Traditional Vs Roth Ira Calculator

Roth Ira Conversion Calculator Excel

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

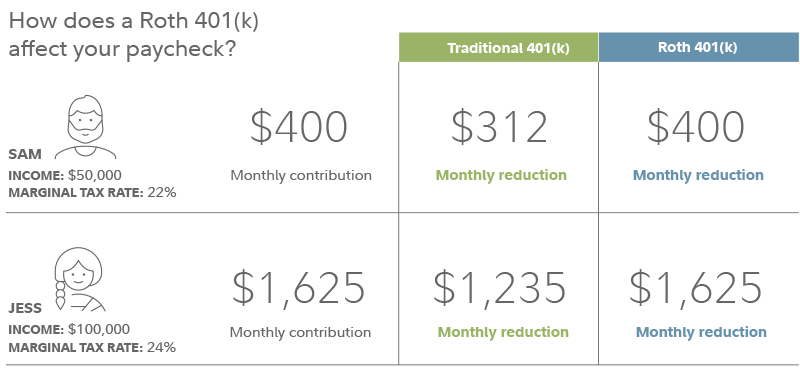

Roth 401k Roth Vs Traditional 401k Fidelity

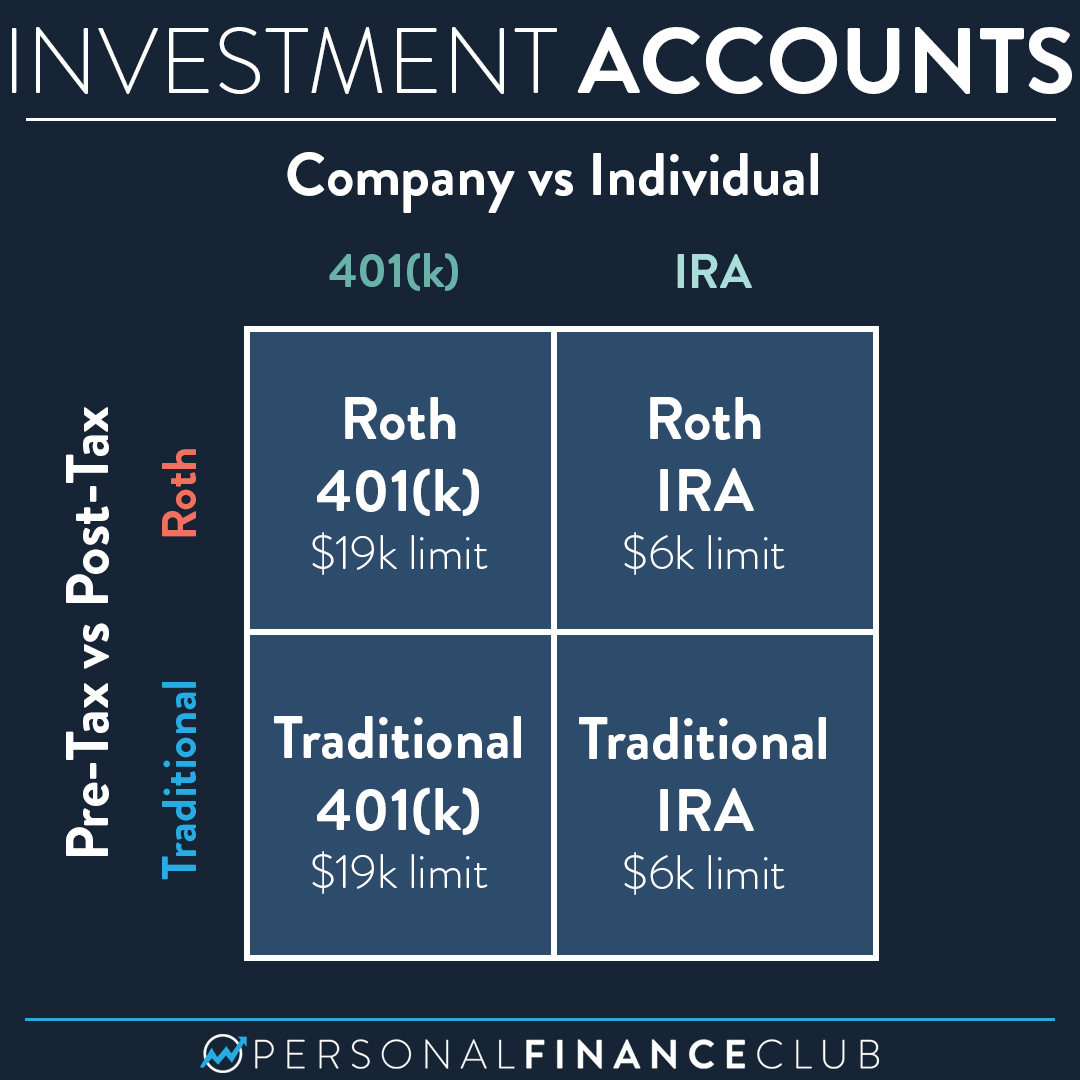

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Retirement Accounts And Tax Benefits Cpa Near Me Tax Acct 602 274 7770

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion Spreadsheet Seeking Alpha

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator